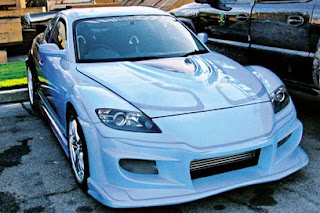

Car modification is an area I have dabbled in myself and I must confess to finding great enjoyment in it. There will always be those who see anyone who modifies their car as a “Boy” or “Girl” racer. Of course, this may be the case for some, but others spend a huge amount of time and money on their beloved cars. The last thing on their mind would be driving dangerously and jeopardising the safety of their most precious item.

The modifying of your car can provide a welcomed focus and is certainly very enjoyable. There are many hobbies that appear superficially to follow a similar theme. Modifying a Pc and adding the latest parts, such as a new processor to increase performance is very similar to adding a new component to a car to increase speed and performance. Indeed, it can be said that to many of us, most things in life can come down to speed or performance in one way or another.

The topic that will never be far from this one is that of modified or performance car insurance. Of course if you modify and improve the performance of your car you will pay a higher premium price. Nevertheless, for some of us it can be a struggle to find a car insurance company even willing to insure a modified or performance car in the first place. Then you will have to consider paying an extortionate amount to cover your car, leaving most us a nervous wreck.

The problem lies mainly in the engine modification department. Changes to exterior fittings such as tailgate spoilers, new alloy wheels and body kit will make a noticeable difference in your premium, but at least this is an area most insurance companies are willing to cover. When it comes to engine modifications and cars with extremely powerful engines, a lot of them will not even enter into giving you a quote.

The problem lies mainly in the engine modification department. Changes to exterior fittings such as tailgate spoilers, new alloy wheels and body kit will make a noticeable difference in your premium, but at least this is an area most insurance companies are willing to cover. When it comes to engine modifications and cars with extremely powerful engines, a lot of them will not even enter into giving you a quote.If you have added only exterior items or changed the in-car entertainment system then you can pretty much go ahead and search through quotes in the usual manner. You must remember to ring the car insurance company you have chosen after selecting the best quote for your car as standard. I would suggest picking several of the better value for money quotes, ensuring they give you the coverage your looking for (remember cheapest is not always best) and then ringing the company to continue the quote and give details of your modification. You should find most companies are pretty modification friendly as long as there only minor changes.

If you have modified you engine by way of a chip, induction kit or similar then things start to get a little trickier. This is also the case with having a generally high-powered performance engine. Many mainstream insurers will not insure a car with engine modifications or a high-powered car with a young driver. Here you will be best to follow the same procedure as above and seek quotes from specialist insurers. You may find the process a little slower but you will be rewarded with a more tailored and possibly cheaper policy.

If you have modified you engine by way of a chip, induction kit or similar then things start to get a little trickier. This is also the case with having a generally high-powered performance engine. Many mainstream insurers will not insure a car with engine modifications or a high-powered car with a young driver. Here you will be best to follow the same procedure as above and seek quotes from specialist insurers. You may find the process a little slower but you will be rewarded with a more tailored and possibly cheaper policy.Above all, you must remember to be honest to your insurer. Something as small as misinforming the insurer as to where you car will be kept overnight can be seen as fraud. Altering details to give yourself a cheaper policy, if not accurate, will ultimately result in voided insurance when the issuing company finds out.